* The indicative performance notifications herein above were determined based on the following stipulations: The Estimated Annualized IRR is the expected net operating income and divided by the capitalization rate of the asset. An investment’s Estimated Annualized Avg Cash Yield is determined by deducting fees and expenses from the current rent roll and other cash flows. We confirm these numbers by comparison with comps received from appraisers. The performance notifications are hypothetical based on the methodology herein above indicated and the actual performance of an investment as stated will vary over time and might not be attained.

In addition, at the end of the term or upon an earlier sale of the property, the iintoo investor entity will be eligible to receive priority over the Sponsor and other equity holders in the return of their invested capital plus any additional amount needed to achieve the targeted preferred return, to the extent not previously received from ongoing cashflow.*

Please see Private Placement Memorandum for further details.

*The Sponsor has the right to refinance the bank loan 12-18 months from deal closing in order to return to the other equity investors their invested capital ($4,327,281) prior to the iintoo investor entity.

* Only available in select markets.

| Uses (USD) | |

| Acquisition Price | 35,618,531 |

| Capital Improvements | 2,730,000 |

| Purchase Costs | 140,000 |

| Working Capital & Other Reserves | 682,500 |

| Total Uses | 39,171,031 |

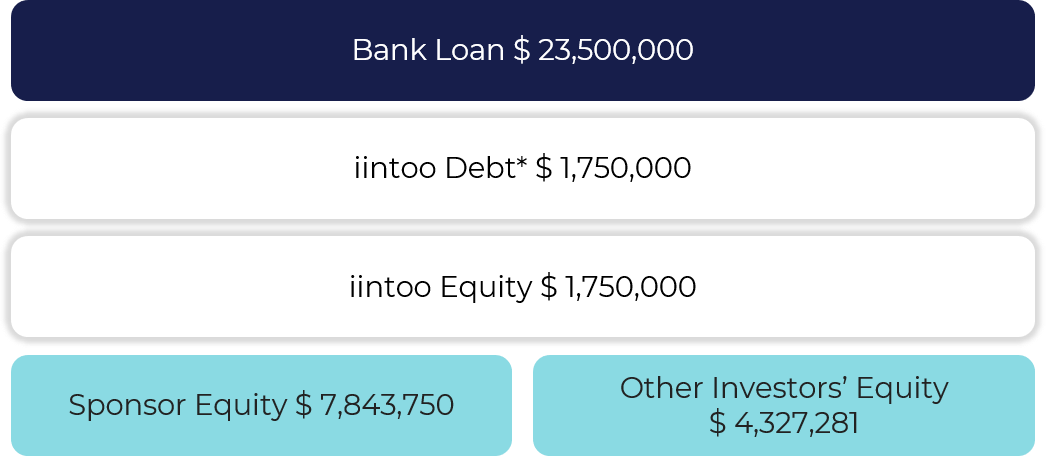

| Sources (USD) | |

| Sponsor and Other Investors Equity | 12,171,031 |

| iintoo Equity Investors | 1,750,000 |

| iintoo Debt Investors | 1,750,000 |

| Total Equity | 15,671,031 |

| Bank Loan | 23,500,000 |

| Total Sources | 39,171,031 |

The Business Opportunity

Experienced Local Sponsor

Attractive Market

Price and yield differential are drawing new capital to outer NY boroughs like Queens, where cap rates are up to 50 basis points higher than more premier locations**

*Source: NAI Queens, 2Q19 New York Commercial Real Estate Market Report

**Source: Marcus & Millichap, New York City 2019 Retail Investment Forecast

Backed by Personal Guarantee From Sponsor

General

Location

Nearby Transportation

Nearby Businesses

Seniority

Headquartered in Queens, NY

Industry Expertise

Subsidiaries include AB Capstone, AB Capstone Builders, and AB Capstone Management.

SQF track record

Asset Value Track Record

Regions of Expertise

- Compared to other New York City submarkets, Northeast Queens shows low vacancy rates in both office properties (2.5%) and in retail properties (3.6%).*

-Price and yield differential are drawing new capital to outer NY boroughs like Queens, where cap rates are up to 50 basis points higher than more premier locations**

Sources:

*NAI Queens, 2Q19 New York Commercial Real Estate Market Report

**Marcus & Millichap, New York City 2019 Retail Investment Forecast

| Projected Cash Flows (USD) | Year 1 | Year 2 | Year 3 |

| Rental Income | 816,398 | 2,471,228 | 2,495,709 |

| Property Taxes | (46,919) | (144,979) | (149,328) |

| Insurance | (9,751) | (30,132) | (31,036) |

| Repairs, Maintenance & Turnover | (15,457) | (47,761) | (49,194) |

| Utilities | (11,381) | (35,168) | (36,223) |

| Marketing & Administration | (4,274) | (13,207) | (13,603) |

| Management Fee | (23,246) | (70,267) | (70,894) |

| Total Expenses | (111,028) | (341,514) | (350,278) |

| Net Operating Income (NOI) | 705,370 | 2,129,714 | 2,145,431 |

| Debt Service | (115,606) | (1,387,270) | (1,387,270) |

| Net Cash Flow Before Tax | 589,764 | 742,444 | 758,160 |

| Project CoC | 3.8% | 4.7% | 4.8% |

| Expected Cash Flow to iintoo Investors | 455,000 | 455,000 | 455,000 |

| iintoo Asset Management Fee | 87,500 | 87,500 | 87,500 |

| Capital Reserve | 87,500 | 87,500 | 87,500 |

| Expected Cash Flow to iintoo - Debt Investors (9% Interest) | 157,500 | 157,500 | 157,500 |

| CoC Debt Investors | 9.0% | 9.0% | 9.0% |

| Expected Cash Flow to iintoo - Equity Investors | 122,500 | 122,500 | 122,500 |

| Expected CoC to iintoo - Equity Investors | 7.0% | 7.0% | 7.0% |

The figures herein above are displayed for illustrational purposes only and are not actual or projected investment performance stipulations. There is no guarantee that this proposed investment will yield profit. Past performance is not a guarantee of future results. Any investment may lose value.

| Projected Profit Calculation and Waterfall (USD) | |

| Projected Profit Calculation and Waterfall | |

| Distribution Waterfall Among iintoo, Sponsor and Other Investors in the JV | |

| NOI for Sale Price Calculation | 2,145,431 |

| Residual Asset Value @ 5.02% CAP | 42,759,264 |

| Cost of Sale 3% | (1,282,778) |

| Net Sale Proceeds | 41,476,486 |

| Profit Calculation | |

| Net Sale Proceeds | 41,476,486 |

| Proceeds from Operation | 2,090,368 |

| Total Proceeds | 43,566,855 |

| Bank Loan | (22,068,531) |

| Total Proceeds for Distribution | 21,498,323 |

| Distribution Waterfall | |

| Expected Cash Flow to iintoo Investors | 1,365,000 |

| Return of Remaining Capital Contribution - iintoo Investors | 2,135,000 |

| Preferred Return to iintoo Investors (13%) | 1,365,000 |

| Total Proceeds - iintoo Investors | 4,865,000 |

| Remaining Proceeds - Sponsor and Other Investors | 16,633,323 |

| Total Project Proceeds | 21,498,323 |

The figures herein above are displayed for illustrational purposes only and are not actual or projected investment performance stipulations. There is no guarantee that this proposed investment will yield profit. Past performance is not a guarantee of future results. Any investment may lose value.

| Projected Profit Distribution - iintoo Investors - after 36 Months (USD) | |

| iintoo Investors Share | 4,602,500 |

| Return of Capital Contribution to iintoo Debt Investors | 1,750,000 |

| Interest Payments to Debt Investors 9% per Annum | 472,500 |

| Return of Capital Contribution to iintoo Equity Investors | 1,750,000 |

| Profit Remaining for Distribution to Equity Investors * | 630,000 |

| Total Profit Distribution to iintoo Investors | 4,602,500 |

| *iintoo Success Fee for Equity Investors | No fee |

The figures herein above are displayed for illustrational purposes only and are not actual or projected investment performance stipulations. There is no guarantee that this proposed investment will yield profit. Past performance is not a guarantee of future results. Any investment may lose value.

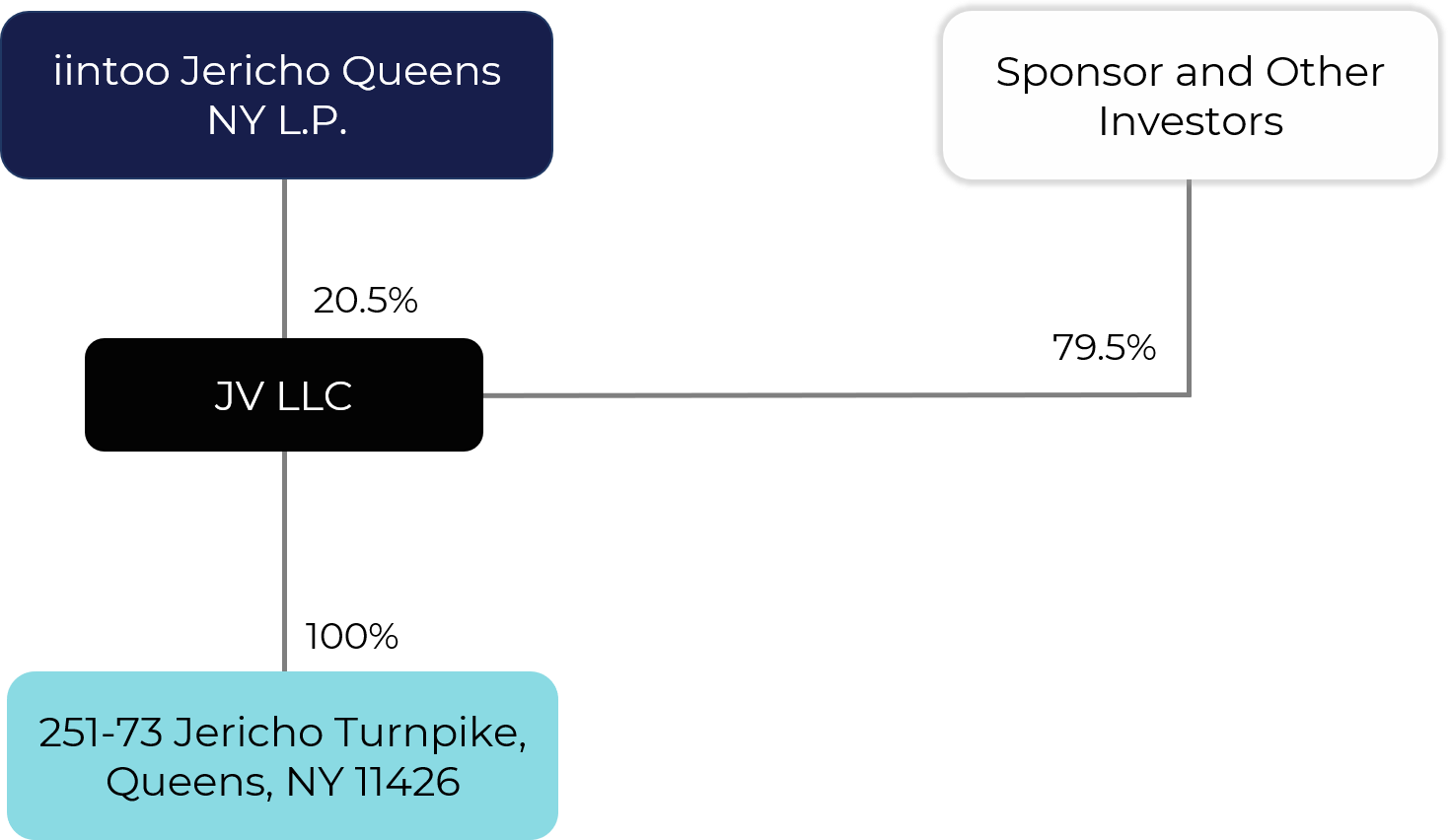

The iintoo investor entity is expected to hold a 20.5% stake in the special purpose entity that owns the asset.

Ownership of the asset is via a designated SPV held by investors. The principal of the Sponsor provides a personal undertaking of the obligations of the Sponsor under the JV agreement. iintoo will oversee and monitor the project until its completion and provide investors with quarterly progress reports.

See Private Placement Memorandum for further details

The Sponsor has a contractual option to buy out iintoo’s investors stake between 18-36 months from the closing date at a pre-agreed price.

See Private Placement Memorandum for further details.

About iintoo

The above may contain forward-looking statements. Actual results and trends in the future may differ materially from those suggested or implied by any forward-looking statements in the above depending on a variety of factors. All written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the previous statements. Except for any obligations to disclose information as required by applicable laws, we undertake no obligation to update any information contained above or to publicly release the results of any revisions to any statements that may be made to reflect events or circumstances that occur, or that we become aware of, after the date of the publishing of the above.

Private placements of securities accessible through the iintoo™ social network real-estate investment platform (the “Platform”) are intended for accredited investors. Such private placements of securities have not been registered under applicable securities laws, are restricted and not publicly traded, may be subject to holding period requirements, and are intended for investors who do not need a liquid investment. These investments are not bank deposits (and thus are not insured by the FDIC or by any other federal governmental agency), are not guaranteed by and iintoo Investments Ltd. (“iintoo”) or any third party working on our behalf, and may lose value. Neither the Securities and Exchange Commission nor any federal or state securities commission or regulatory authority has recommended or approved any investment or the accuracy or completeness of any of the information or materials provided by or through the Platform. Investors may lose their entire investment as private placements are speculative and illiquid.

Equity securities are offered through Dalmore Group LLC. ("Dalmore"), a registered broker-dealer and member of FINRA (www.finra.org), member of SIPC (www.sipc.org). Any real estate investment accessible though the Platform involves substantial risks. Any financial projections or projected returns are projections only, and iintoo makes no representations or warranties as to the accuracy of such information and accepts no liability therefor whatsoever.

Investors should always conduct their own due diligence, not rely on the financial assumptions or estimates displayed herein, and should always consult with a reputable financial advisor, attorney, accountant, and any other professional that can help them to understand and assess the risks associated with any investment opportunity. Any investment involves substantial risks. Major risks, including the potential loss of some or all principal, are disclosed in the private placement memorandum for each applicable investment.

Neither iintoo nor its affiliates nor Dalmore Group LLC makes investment recommendations nor do they provide investment advisory services, and no communication, including herein or through the Platform or in any other medium should be construed as such. iintoo, its employees and affiliates are not insurers or insurance brokers, and do not offer insurance services, advice or information to new or existing investors.

The Terms of Use regulating your use of the Platform can be found at: https://www.iintoo.com/about-us/terms-of-use/

The Platform's Privacy Policy can be found at: https://www.iintoo.com/about-us/privacy-policy/

By accessing this site and any pages thereof, you agree to be bound by our Terms of Use and Privacy Policy.